Local consumers will soon be able to savour South Korean pears with the government clearing the way for import of the fruit after pest-risk analysis. Import of pears from South Korean has received a green signal at a time when inbound shipment of the fruit from China remains suspended— for almost a year now— on account of pests being repeatedly found in the consignments. India imports pears from the US, CIS countries and South Africa. In the April-February period of 2017-18, the country imported pears worth about $15.19 million. This is the first fruit import from Korea. Besides being a positive for bilateral trade, the move will give options to Indian consumers.

The cost of borrowing for Indian importers has climbed about 200-250 basis points after the banking regulator banned guarantees such as Letter of Undertaking (LoU) and Letter of Comfort, instruments that were used before. Some bulge-bracket foreign banks and Indian lenders are now taking more fund based exposure to the $400-450 billion import financing market and earning a higher revenue from importers by using costlier product. Lenders are also forcing importers to hedge foreign exchange risk on their overseas currency loans after the rupee’s recent slide against the dollar. Three products — Standby Letter of Credit (SBLC), Foreign Currency Loan and Suppliers Credit — have now gained currency in lieu of the erstwhile guarantees. Some importers are also availing themselves of foreign currency denominated loans (FCNR Loans) against their foreign currency bank deposits. In the absence of LoUs, importers are availing SBLC mostly from local branches of bigger foreign banks. In the absence of LoUs, importers are availing SBLC mostly from local branches of bigger foreign banks. They discount such instruments in overseas branches of those foreign banks that charge about 1% extra compared to what they used to against LoUs. SBLC and FCNR credit lines are a bit expensive for importers.

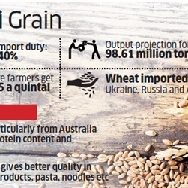

The government is likely to raise the import duty on wheat to 40% from 20% to protect local farmers from cheap imports. Wheat imported from Ukraine and Russia is available for about Rs 22,300 a tonne after payment of 20% duty and clearing charges. This is offering stiff competition to the variety grown in Madhya Pradesh which is selling for Rs 22,800 a tonne in Bengaluru. On the other hand, premium wheat from Australia, which is available for Rs 24,300 a tonne, has steady clients in southern India. If duty is increased, millers in south India, who are aggressive buyers of wheat from Ukraine, Australia and Russia, are unlikely to go for imports. The increase in import duty will force millers to increase domestic buying, which may increase prices.